October 13, 2022

INTRODUCTION

Description of the Assignment

“Microsoft enables digital transformation for the era of an intelligent cloud and an intelligent edge. Its mission is to empower every person and every organization on the planet to achieve more” (Microsoft, 2022). This valuation report has been produced for the sale of a minority stake in the company.

Standard of Value

The premise of value is that Microsoft, Inc. is a “going concern.” The standard of value in this valuation report is fair market value. Other premises of value, such as liquidation, and other standards of value, such as investment value, are invalid.

Microsoft, Inc.

Brief History/Overview

Nature, Background, and History

“Microsoft Corporation is an American multinational technology company that develops and sells a wide range of consumer and enterprise software, hardware, services, and consumer electronics” (Vailshery, 2022). Bill Gates and Paul Allen founded the company in Albuquerque, New Mexico, in 1975. The company has and operates the following business segments (Forbes, 2022):

- The Productivity and Business Processes segment includes the products and services in productivity, communication, and information services of the company through various devices and platforms.

- The Intelligent Cloud segment includes the company’s public, private, and hybrid serve products and cloud services, which support modern businesses.

- The More Personal Computing segment “encompasses products and services geared towards the interests of end users, developers, and I.T. professionals across all devices.”

- The firm produces operating systems, video games, personal computers, phones, laptops, gaming and entertainment consoles, and other technology-related products. The firm’s mission is to empower every person and every organization on the planet to achieve more (Microsoft, 2022).

Facilities

The company is headquartered in One Microsoft Way, Redmond, WA 98052-7329, USA. Being an international company, Microsoft has numerous office locations worldwide; for example, the company has office locations in Angola, Belgium, Canada, Japan, and more. A complete list can be viewed at this link.

In addition to offices worldwide, the company has several Research & Development centers in the US, India, China, the UK, Canada, the Czech Republic, Ireland, and Israel. It also operates and finds new talents through Microsoft Research, “a computer science research organization that work in close collaboration with top universities around the world” (MarketLine, 2022).

Customers

The company’s customer base ranges from individuals to businesses. For example, Microsoft’s Azure Platform’s customers include eBay, Boeing, and Samsung (Sudhanshu D., 2019). Microsoft’s consumer products’ customers include everyone from all walks of life.

Management

Satya Nadella has been the company’s chairman and Chief Executive Officer since 2014. However, there are CEOs for each country the company is in, but she governs over all of them. For example, Microsoft U.K. has Clare Barclay as CEO. Other positions in management include the directors, executive vice president, secretary, managing directors, and chief scientific officer.

Competition

Microsoft is the largest software company in the world by sales revenue, but since the company offers software, cloud, and devices, it has competition in all those areas. Notable competitors in software and devices segments are Apple Inc. and Alphabet Inc. While Microsoft owns a 70.68% share of the desktop computer operating system market, it only owns 22% in the IaaS market and 4.7% in the global P.C. market (Vailshery, 2022).

Strengths and Weaknesses

According to the Market Line report on Microsoft Corporation published on August 29, 2022, the company has the following strengths:

- “Strong research and development capabilities lead to efficiency outputs.

- Integrated model of distributions tends to enhance the distribution channels and productivity,

- Increased financial performance tends to achieve adequate funds for its future growth.”

This combination indicates that the company is doing well and can continue to operate in the future. Its’ strong position also indicates a high value to its stocks. However, with strengths come weaknesses. The same report by Market Line identified the following weaknesses of the company:

- “Increasing Trade Receivables could affect profitability.” It is a fact that not all receivables are in good health and may become bad debts.

Ownership

According to the Market Line report on Microsoft Corporation, RBA Consulting acquired Microsoft’s CRM and Office 365 division of Meritide on June 28, 2012. Market Line has no other reports of ownership on Microsoft. However, according to CNN Business’s report (2022), institutional investors have the major ownership of MSFT by 71.57%. Individual stakeholders hold 6.31%, mutual fund holders hold 41.39%, and other institutional shareholders hold 30.18% of MSFT.

Major Shareholder Transactions

The Vanguard Group, Inc., holds 8.01% or 597,549,927 MSFT shares at a total value of $167,756,166,506. Next in line is the BlackRock Fund Advisors, which holds 4.47% or 333,373,626 shares at a total value of $93,591,311,763. The third is the SsgA Funds Management, Inc., which holds 3.94% or 293,557,993 at a total value of $82,413,470,955.

Business Risks

According to the Market Line report (2022), the company had the following threats or risks to the business:

- “Intense competition increases the risk across the market.

- Fluctuations in foreign currency which leads to economic risk.

- Security breach could lead to data leak and cause lack in confidence among customers.”

These risks are similar to the risks other multinational technology companies are facing. Microsoft must continually conduct R&D to improve and offer new products to retain its large market share in the desktop computer operating system and increase its shares in other markets. The company must also continue to secure customers’ data to maintain their trust and confidentiality.

FINANCIAL ANALYSIS

Financial Analysis Overview

The company’s balance sheet and income statement accounts generally trend upward in the last five years. The Cash and Cash Equivalents account is the largest valued account on the balance sheet. It suggests that the company is liquid. The company’s capital structure is comprised of debt and shareholders’ equity. The shareholders’ equity ratio is currently at 45.65% in 2022 (Wall Street Journal - Markets, 2022). Microsoft has off-balance sheet arrangements stated on the 2021’s annual report, but the obligations they had “did not have a material impact in our consolidated financial statements during the periods presented” (Microsoft, 2021).

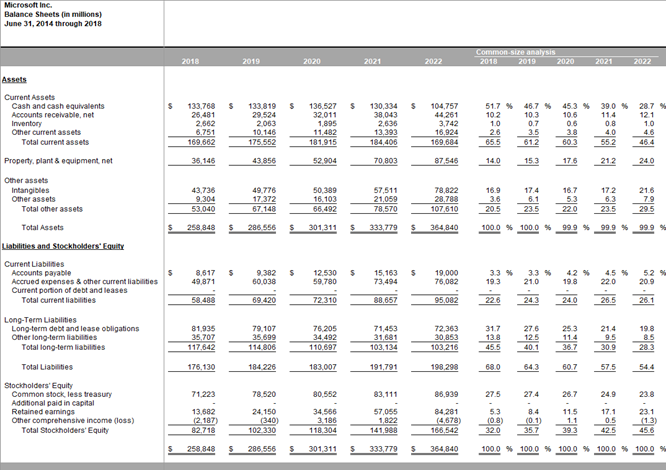

Balance Sheets

Horizontal Analysis

The horizontal analysis of the company’s balance sheet does not seem to have a pattern in the percentages or dollar change. In some years, the trend is expected to go up then it fluctuates (Total Current Assets). The horizontal analysis helps spot changes but does not show the complete picture. If one bases the company’s health on this analysis alone, one can see a volatile company. However, this is not the case for Microsoft. If the financial statements, ratios, and non-financial factors (customer loyalty) were considered, one could see that this is a solid and stable company.

The horizontal analysis of the company’s income statement indicates that Sales grew each year steadily. I expect this pattern will continue in the future as well. Cost of Sales also has an upward trend, except for the dip it experienced in 2020 (from 10.11% in 2019 to 2020 in 7.38%). In that year, the company was able to keep costs down. The year 2021 saw the most increase in Net Income before tax by 34.06%. While the percentage and dollar difference may change yearly, the company is still doing great. I suggest the company consider cutting costs in the Other Income (Expense) if possible.

Assets

Microsoft’s current assets tend to trend upwards but have dropped in 2022 because the Cash and Cash Equivalents account has significantly decreased. However, other line items such as net accounts receivable, inventory, and other current assets have continuously trended upwards. Microsoft’s Intangibles account has also increased significantly. A possible reason for this is the further development of their software products leading to a higher valuation. Microsoft’s software has penetrated the personal computing market, and it is impossible not to use their software. In addition, the acquisition of new copyrights and patents has helped increase this account.

Liabilities

The company’s liabilities trend upwards and are mainly concentrated in the long-term debt and lease obligations. However, some debts are tied to contractual or lease obligations. Despite the increase in liabilities, the company remains liquid.

The company’s liquidity ratios have steadily decreased, but the number has consistently been above one. While its numbers are not as attractive as in 2018 (current ratio of 2.90 and quick ratio of 2.74), the company still has good liquidity ratios in 2022 (current ratio of 1.78 and quick ratio of 1.57).

The company primarily relied on debt financing in 2018, as indicated by its debt-to-equity ratio of 2.13. It worked towards minimizing its reliance on debt financing. This effort showed 1.80 in 2019, 1.55 in 2020, a little slip in1.35 in 2021, and 1.19 in 2022. This indicates that despite increasing liabilities yearly, the company has been working towards capital financing. Currently, the company is liquid, owning more assets than liabilities. This indicates that the company has an appropriate level of manageable debt.

Stockholder’s Equity

Stockholder’s Equity has also trended upward. Microsoft combines the accounts, Common Stock and Paid-in Capital into one. However, the company has only authorized 24,000 shares, with 7,519 of those outstanding. The reported earnings-per-share of MSFT stock has also increased throughout the years, and from 2020 to 2021, the EPS has significantly increased. The EPS in 2020 was $5.82 for basic and $5.76 for diluted, while in 2021, the EPS was $8.12 for basic and $8.05 for diluted.

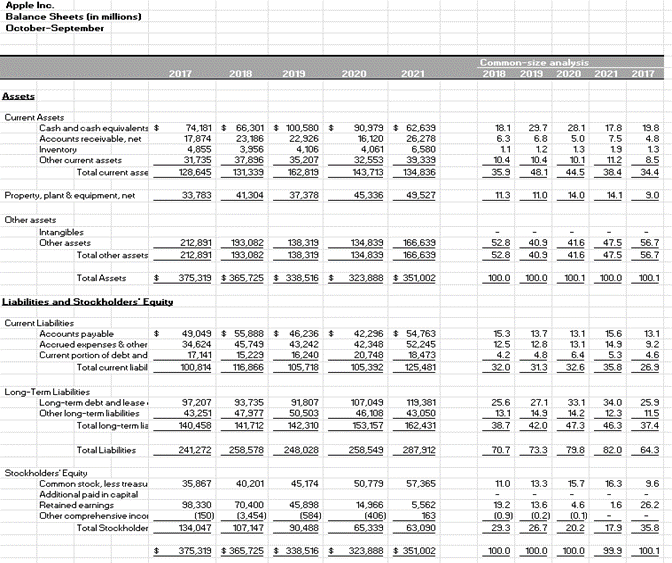

Comparison

A well-known competitor of Microsoft is Apple, which has the ticker AAPL. Below is Apple’s balance sheet taken from the Wall Street Journal. The competition’s fiscal year ends in September. Thus, there are only financial statements from 2017 to 2021. Like Microsoft’s financial statements, Apple’s financial statements have been consolidated to fit the accounts in Business Valuation Template.

On Apple’s Balance sheet, it seems like a weak company. Its’ total current assets started strong from 2017 to 2019 but plummeted in 2020 and 2021. The same pattern can be found in other accounts; however, liabilities have continued to climb upward. On the other hand, Microsoft can learn from Apple in keeping its Cost of Goods Sold down. Apple has managed to minimize COGs in its Sales. Sales Growth in 2018 was 16.29%, -2.20% in 2019, 5.46% in 2020, and 33.44%. Meanwhile, COGs Growth in 2018 was 15.61%, -0.95% in 2019, 4.86%, and 25.18% in 2021 (Wall Street Journal, 2022). The percentages may be hard to imagine, but Apple has managed to keep COGs low while revenues are high. Apple is also doing something right in keeping its customers loyal to its products. Another strategy Microsoft can learn from Apple is offering its products through telecommunication providers such as AT&T, T-Mobile, Verizon, or similar. It also helps product penetration, especially since Microsoft’s phone line (such as the Surface Duo) is not well-known to the public.

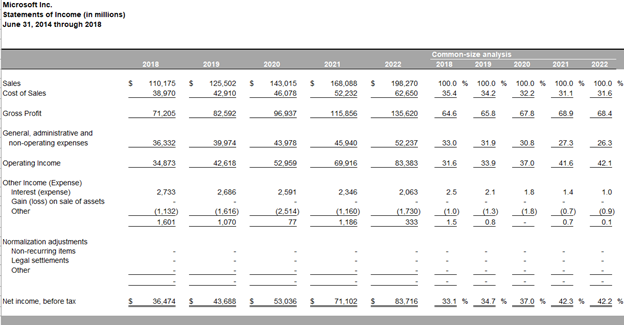

Income Statements

Microsoft’s Income Statement has increased every year. It has significantly increased in 2020 ($53,036) and 2021($71,102) and carried the momentum in 2022 ($83,716). In 2021’s Annual Report, it is stated that revenue increased by 18% across all the segments. However, the Cost of Revenue has also increased by 13% because of the rapid growth and demand for cloud services and gaming. This new demand means that there is also a sharp increase in operating expenses by 4% or $2.0 billion.

Normalization Adjustments

Based on the annual reports, there are no anomalies such as disasters the company has experienced. The recent COVID-19 pandemic, which has affected everyone and every company, has only increased the demand for cloud usage, P.C.s, productivity tools, and gaming platforms (Microsoft 2021).

Profitability

Using the appropriate profitability ratios, one can determine whether this company is a great investment choice. Since the Excel template only focuses on specific accounts and not the complete picture, I opted to use another source for the ratios. The source is Macro Trends.

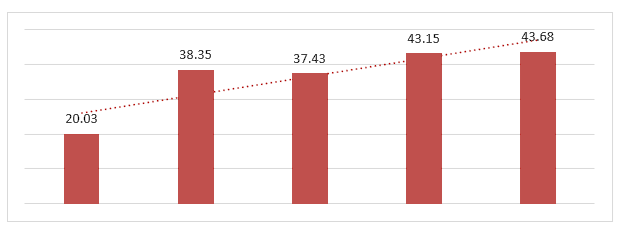

Return on Equity is “the rate of return on the money that equity investors have put into the business” (Corporate Finance Institute, 2020). A high ROE attracts more investors to purchase the company’s stock because it means that the company can generate more cash internally without having to depend on debt financing (Corporate Finance Institute, 2020). The horizontal axis indicates the year in increasing order, 2018 to 2022. It trends upwards and is expected to be the same in the following years.

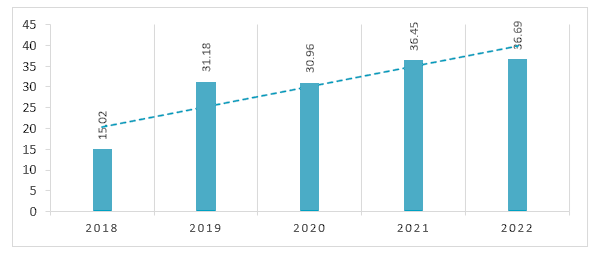

Return on Total Assets indicates how effectively a company uses its assets to generate sales and profits (Hayes, 2022). The higher, the better. In Microsoft’s case, the ROA increased yearly and trended upward. The same pattern is expected in the following years. The chart below shows this gradual increase in the ROA.

Net Profit Margin is “a company’s net income and divides it into total revenue. It provides the final picture of how profitable a company is after all expenses, including interest and taxes, have been taken into account” (Corporate Finance Institute, 2020). The company’s net profit margin trended each year upward and is expected to do the same in the following years.

With all these three ratios combined, Microsoft is considered a profitable company and a great investment choice. It is also expected to do well in the future. Vertical analysis of the company’s income statement also solidifies this claim. The base figure used in the analysis is the sales for each year. A typical pattern emerges when examining the analysis: the expense percentages decrease yearly, allowing for a higher net income-to-sales ratio. This indicates that the company is managing its expenses well.

Free Cash Flow

Free Cash Flow “is the cash a company generates after taking into consideration cash outflows that support its operations and maintain its capital assets” (Murphy, 2022). The pictures below are taken from the Wall Street Journal and depict the company’s Cash Flow Financial Statement.

Microsoft’s free cash flow has increased throughout the years. In 2018, the company’s cash flow was only $32,252. In 2019, it was $38,260. In 2020, $45,234. In 2021, $56,118. In 2022, $65,149.

(Wall Street Journal on Microsoft’s Cashflow)

Microsoft has been in excellent financial health for the past five years. The company is expected to be in the same state in the following years. It can use the available discretionary cash to expand the company further, pay some of its debts, or pay dividends to its shareholders.

Dividend Paying Capacity of the Company

According to the company’s Cash Flow statement, it has continuously paid its shareholders cash dividends in the past five years. As the company grew, the total cash dividends paid also grew. This continuous payment of cash dividends makes investing in the company more attractive to investors. According to Fidelity (2015), “consistent dividends are often viewed by investors as a sign of a company’s strength and that the company’s management has positive expectations around future earnings growth… [making the company] more attractive to investors, which helps to drive the stock price higher.”

Based on the company’s growing free cash flow, it is on track to pay dividends next year. Based on the trend the Total Cash Dividends Paid account shows, the ratio is expected to increase in proportion to the increased Net Income before Extraordinaries.

INDUSTRY AND ECONOMIC ANALYSIS.

General economic overview

Economic output and consumption.

According to an article in Economic Times by Kulkarni (2014), the five macroeconomic indicators are GDP growth, industrial production, current account deficit, inflation, and interest rates.

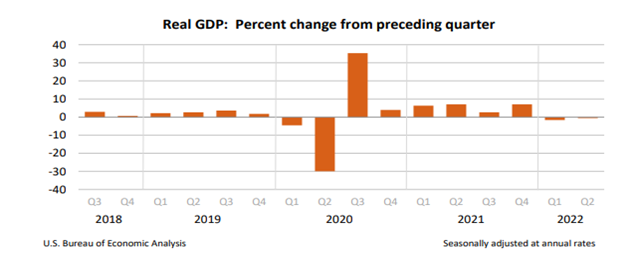

The U.S. GDP has slowed down because of the recent COVID pandemic. While industries such as the entertainment and tourism industries slowed down, the I.T. Hardware and I.T. information industries grew because of the need for remote learning and working. The demand for I.T. Hardware and I.T. Information continues to grow despite the low GDP %.

(U.S. Bureau of Economic Analysis (BEA), 2022)

The second macroeconomic indicator to be discussed is the inflation rate. Inflation makes items rise in prices. However, it is a problem, especially if the salary and wages have not increased congruently with inflation. As a result, it makes it harder for consumers to buy as much as they want. Microsoft, however, is not affected. Microsoft still had a global revenue in FY2021 of $198 billion and a net income of $73 billion. The demand for PCs remains the same, especially with the demand to go remote. However, this trend might change soon since the current U.S. president has announced that the pandemic is over.

Finally, instead of another macroeconomic indicator, a national trend is affecting Microsoft’s supply chain. There has been a shortage of semiconductors. To compensate for this shortage, many consumer electronics companies have increased their prices such as HP (Lisa, 2021). Microsoft may have to increase its prices as well.

Current monetary and trade policy.

The Fed controls the nation’s monetary policy. It must fulfill its goals of maximum employment and stable price or low, stable inflation (the dual mandate)(Federal Reserve Bank of San Francisco, 2012). The Fed accomplishes its job through reserve requirements, discount rates, and open market operations. Currently, the Fed discount rate is 3.25, and the interest rate continuously increases until it hits 4.6% in 2023 (Cohan, 2022).

Trade policies are “a nation’s formal set of practices, laws, regulations, and agreements that govern international trade practices, or imports and exports to foreign countries” (Logue, 2022). However, a difference in any of these two policies may not affect Microsoft immediately, considering the size of this company.

Policies and Regulations

While the Fed tries its best to minimize inflation, I believe Microsoft’s demand is consistent. An effect of inflation is the rising cost of parts. The company must increase its prices to keep up with its demand and to recuperate for the rising expenses.

Any change in trade policy has the same effect as the monetary policy on a company of the same size as Microsoft. Still, there are scenarios where Microsoft would be immediately affected. For example, if Microsoft relies on a Chinese supplier and the current government blocks imports from China, Microsoft may suffer until it finds another supplier. In this scenario, the company would be unable to meet the demand. Instead, the company may resort to a more expensive supplier until a similar price and quality supplier is found.

Industry Analysis

Supply and demand.

The I.T. Hardware industry has a consistently high demand saturation. According to Market Line’s Five Forces Analysis (2022), this industry depends on semiconductor, component, and original design manufacturers. Supplier power is considered moderate, but the I.T. Hardware industry only has a few limited choices as there is an oligarchy in the supplier industries. The companies in this industry can only produce as fast as their manufacturers can, limiting the supply. As a result, Microsoft is affected by this fact.

The recent COVID-19 pandemic has positively affected this industry and Microsoft as well. The pandemic brought lockdowns and the need to continue life remotely. Thus, the demand for P.C.s rose. However, the supply faced challenges: “The semiconductor shortage has been exacerbated by the fact that there simply are not enough containers to ship all the products bought by consumers” (Market Line, 2022). While the COVID-19 restrictions have been lifted, I believe the industry’s demand will drop to its original level before the pandemic and consistently stay at that level. However, one caveat of this prediction is that the semiconductor industry would be able to catch up with the supply.

Market Share And Competitive Landscape.

Microsoft does not hold a significant share of this industry. Microsoft only accounts for a 4.7% share in the global P.C. market (Statista, 2022). Dell, HP, Lenovo, and Apple account for 70% of sales worldwide, but according to Statista (2022), Microsoft has 70.68% of the market share in desktop computer operating systems. It can be seen that while Microsoft’s competition has more hardware sales, its customers ultimately have a Microsoft Windows operating system for their P.C.s.

According to Market Line’s analysis report on the I.T. Hardware industry (2022), only a few large corporations compete against each other in this industry. While this information means fewer new competitors for Microsoft, it also means that Microsoft has to compete fiercely with other corporations with a similar size, financial muscle, and technological edge. These qualities are also what Market Line (2022) attributes as the major players’ competitive advantages. However, this report recognizes Microsoft’s attempts to shake up the competition by focusing on the high-end segment (Market Line, 2022). Microsoft also has a competitive advantage through familiarity, enterprise data and analytics tools, business productivity software, cloud-based services, and artificial intelligence.

Regulation

“I.T. hardware manufacturers are also subjected to a high degree of regulation” (Market Line, 2022). Many agencies oversee the I.T. Hardware standards. An example is the United States Environmental Protection Agency. The following laws and regulations from the EPA bind this industry (United States Environmental Protection Agency, 2013):

- Greenhouse Gas Reporting Program

- National Emissions Standards for Hazardous Air Pollutants (NESHAP): air toxics regulations:

- Degreasing Organic Cleaners (Halogenated Solvent Cleaners)

- Magnetic Tape (surface coating)

- Semiconductor Manufacturing

- Stratospheric Ozone Regulations:

- The Phaseout of Ozone Depleting Substances

- Significant New Alternatives Policy (SNAP) Program: EPA’s program to evaluate and regulate substitutes for ozone-depleting chemicals.

Additionally, other agencies, such as the European General Data Protection, regulate the data privacy and protection of this industry’s consumers. Similar to the European General Data Protection Regulation, a similar privacy law called the American Data Privacy Protection Act (ADPPA) is trying to pass through Congress (Osano Staff, 2022). When this law is passed, the industry must be more mindful of its consumers’ data. Other current laws that the I.T. Hardware industry must be aware of are the following (Osano Staff, 2022):

- “The Children’s Online Privacy Protection Act (COPPA), which governs the collection of information about minors.

- The Health Insurance Portability and Accounting Act (HIPAA), which governs the collection of health information.

- The Gramm Leach Bliley Act (GLBA), which governs personal information collected by banks and financial institutions.

- The Fair Credit Reporting Act (FCRA), which regulates the collection and use of credit information.”

These laws may vary from state to state, so companies in this industry must check before operating in certain states. These rules may sound restrictive, but if followed, it benefits Microsoft because it instills consumer trust. Consumers want their data no longer sold without their consent. A company that can protect consumer data can have another competitive advantage in the industry.

Employment issues.

This industry “requires employees with specific and adaptable knowledge and skilled developers and engineers are key for success in this market, forcing players to rely on the continued service of highly qualified and usually well-paid employees, which results in a high switching cost” (Market Line, 2022). In response to the economic recession, Microsoft has slowed hiring plans and cut a small number of workers, less than 1% (Novet, 2022).

During the COVID-19 pandemic, millions of people were laid off or caught COVID-19 through their jobs. Some positions were not available to work remotely, but the workplace conditions displayed during the pandemic were less than satisfactory in protecting the employees. Hence, “employment in February 2021 was 8.5 million less than in February 2020” (Kochhar & Bennett, 2021). One caveat of this information is that the low-wage and manual labor workers were the most affected by the drop in employment (Kochhar & Bennett, 2021).

Microsoft’s president, Brad Smith, sees a future with stagnating labor pool. The company’s response to the labor market shortage is to boost employee salaries to keep them. Despite this shortage, Microsoft still has 221,000 full-time employees worldwide in 2022 (Market Line, 2022). The company should worry more about its’ supply issues than employee shortages.

Industry outlook.

The I.T. Hardware, of which Microsoft is a part, is expected to have a value of $168.5 billion or 38.5% in 2026 (Market Line, 2022). Based on Microsoft’s current financial statements, the company is also expected to grow in the I.T. Hardware industry. Looking at the company’s increasing trend in its net income also supports this forecast.

BUSINESS VALUATION

Valuation Approaches

Three major approaches can be used to set a business’s value. One can value a business through the Asset Approach, the Income Approach, and the Market Approach. Each approach arrives at a different value based on what the approach focuses on, which is why it is vital to use the appropriate approach for the business.

Asset Approach

This approach concentrates on the company's net value, meaning that the total assets and liabilities are subtracted. This approach is often used for holding or investment companies, businesses generating losses for years, liquidating a business soon, and high-value real estate companies (BizWorth, 2020). The methods used are the book value method, which looks at the company’s balance sheets, and the net assets method, which bases “the value on the difference between the fair market value of the business assets and its liabilities” (BizWorth, 2020).

In Microsoft’s case, one can use the asset approach and book value method and see that Microsoft’s value is only $364,840 as of June 31, 2022. However, under the net assets method, the assets are normalized based on fair market value, and the company’s worth also increases. For example, on the book value method, the Intangibles account for 2022 is only $78,822, but this account includes the priceless Microsoft Office software patents. This number is subject to increase.

Market Approaches

This approach bases the business’s value on reference to “reasonably comparable guideline companies for which transaction values are known.” This method is helpful for publicly traded companies as comparable information is abundant. However, this approach falls short for small businesses, which may struggle to find comparable information. The method used for this approach is to use parameters from the business and the compared business, such as revenues, gross profit, number of employees, and so on (BizWorth, 2020).

In Microsoft’s case, the company is publicly traded. Thus, transaction terms and values are recorded and made available for comparison. One can compare Microsoft to Apple. If Apple’s minority stakeholders sell their shares, Microsoft can use the revenue of that sale as a comparison for its minority shares sale.

Income Approach

The Income approach determines the value of a business “using one or more methods that convert anticipated economic benefits into a present single amount” (BizWorth, 2020). It means that the business is valued on the future earnings it may produce, but because of the time value of money, the present value for the lump sum of these future earnings is used. Profitable businesses often use this method, and the minority stakeholders may also find this method most useful. The methods for this approach are discounting cash flows and capitalizing cash flows.

Selected Method - Income Approach

For Microsoft, the best approach to use is the Income Approach. The company has been profitable for years, and the minority stakeholders may be more interested in knowing that the company will be profitable in the future.

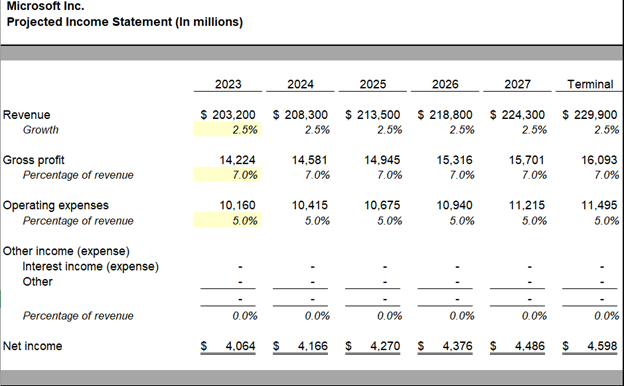

The annual growth rate has been set to 2.5%, corresponding to Microsoft’s gross profit’s consistent growth rate for the past five years. This number is a conservative forecast and may not reflect future events. The annual revenue percentage has been set to 7%, reflecting the company’s yearly gross profit. Finally, the operating expenses have been estimated to be 5% of the revenue. It closely resembles the company’s incremental increases in expenses.

Prospective Analysis

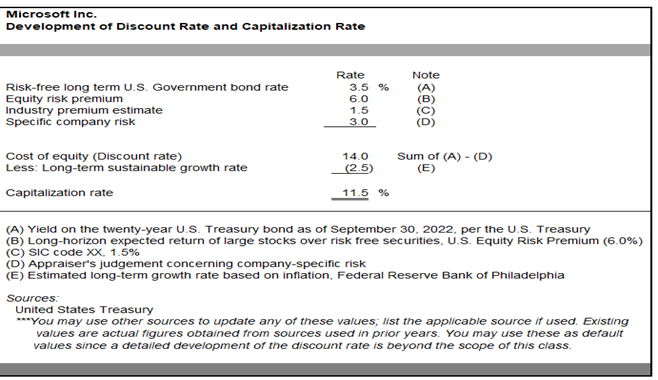

Discount rate

The discount rate “represents the required rate of return for an investor to invest in the business” (Reichenbach, 2020). The discount rate is used in the selected valuation method to determine the company's future value in the present term. These factors make up the discount rate: the risk-free rate, equity risk premium, size premium, industry risk premium, and specific company risk premium.

The risk-free long-term U.S. Government bond rate has been updated to 3.5% to reflect the recent change (Y Charts, 2022). It is the rate that assumes that a company earns on a riskless government. The equity risk premiums are much less specific than the U.S. treasuries, and investors often demand higher returns for these risks (Reichenbach, 2020). For Microsoft, its equity risk premium is expected to be 6.0%. The industry premium is what investors expect from the company's industry and is rated at 1.5% for this industry. Finally, the specific company risk is subjective and is based on the company’s situation and is expected to be at 3% for Microsoft.

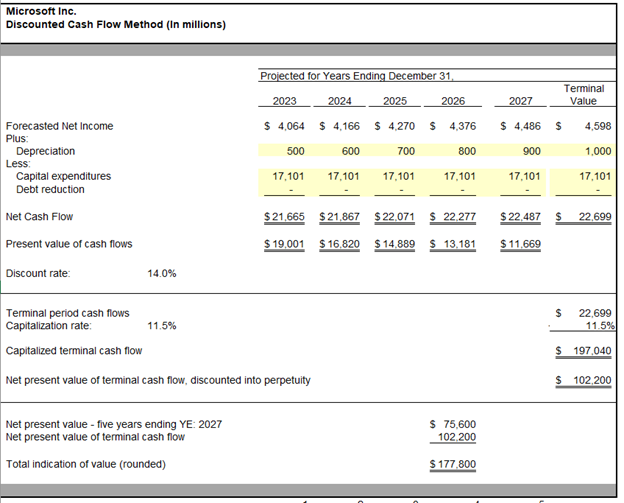

Valuation calculation

The depreciation amounts have been based on Microsoft’s previous five years of depreciation increase. The depreciation increase has seemed consistent in its rate. As a result, the depreciation amount in the projected years follows. The capital expenditures are based on the average of the company’s capital expenditures for the previous five years. Based on Microsoft's liabilities from the past five years, debt reduction has been estimated to be zero. Microsoft’s liabilities have not decreased but increased as the company grew in size and income. Finally, the amount for the capital expenditures has been derived from the average of the company’s previous five-year capital expenditure cash flow. The amount makes sense as the company is expected to grow.

DISCOUNTS AND PREMIUMS

Discount for Lack of Control

- Recall that this valuation's purpose was to sell a minority stake in the company. Currently, the Vanguard Group, Inc. holds 8.01% of shares. Next in line is the BlackRock Fund Advisors, which holds 4.47% of shares. The third is SsgA Funds Management, Inc., which holds 3.94% of the shares.

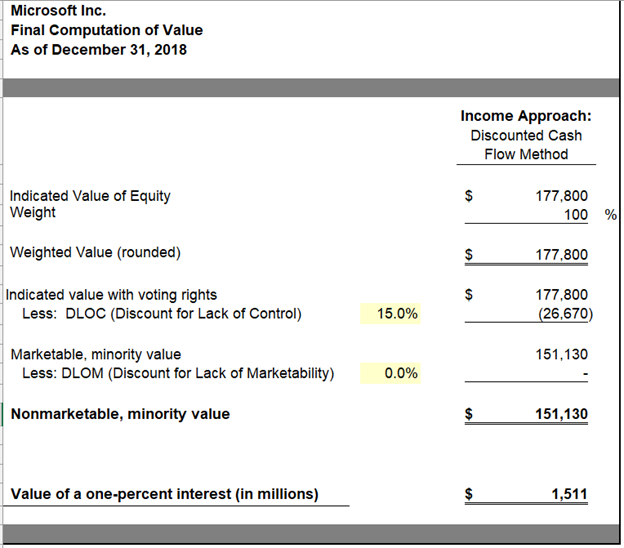

- The minority shareholders may not be able to decide on the major decisions for the company as those privileges are reserved for the major stockholders. These privileges may include appointing or changing management, declaring and paying cash dividends, blocking any of these actions, and more. Thus, there might be a need for a discount. A discount for lack of control “is a fixed amount or percentage deducted from the selling price of a block of shares. The amount is deducted from the share value because that block of shares lacks some or all powers of control in the firm” (Gordon, 2022). For Microsoft, the discount amount of 15% is assumed, as most of the privileges go to its major shareholders.

Discount for Lack of Marketability

The discount for lack of marketability only applies to private companies not publicly traded on financial exchanges, such as the New York Stock Exchange (NYSE), during valuation (CFI Team, 2022). In addition, Microsoft’s stocks are traded daily and are considered a “blue-chip” stock. Microsoft also pays dividends to its shareholders consistently. The company also is considered liquid, has been operating for years, and has continued to improve its products. As a result, the company is highly marketable. Thus, the discount for lack of marketability for Microsoft is 0.

FINAL CALCULATION OF VALUE

The company’s minority stake sale is valued at $15.1 billion using the income approach and discounted cash flow method. This value has been derived from the indicated value of equity, which is $177,800, weighted 100%. The DLOC has been kept at the conservative rate of 15% because the minority stakeholders do not hold many privileges as the major stakeholders. Finally, the DLOM is rated 0 because the company is highly marketable, and its shares are publicly traded through financial exchange services.

SOURCES

The following sources were used to derive the conclusions in this report and the ultimate calculation of value:

- Current and historical financial statements were obtained for the years ended 2022:

- Forbes. (2022). Microsoft | MSFT Stock Price, Company Overview & News. Forbes. https://www.forbes.com/companies/microsoft/?sh=59d1ee3b73f7

Macrotrends. (2022). Microsoft Financial Ratios for Analysis 2009-2022 | MSFT. Macrotrends.net. https://www.macrotrends.net/stocks/charts/MSFT/microsoft/financial-ratios

Market Line. (2022, August 29). Microsoft Corp - Profile Microsoft Corp | MarketLine Intelligence Center. Snhu.edu. https://advantage-marketline-com.ezproxy.snhu.edu/Company/Profile/microsoft_corporation?swot

Vailshery, L. S. (2022, August 31). Topic: Microsoft. Statista; Statista. https://www-statista-com.ezproxy.snhu.edu/topics/823/microsoft/#topicHeader__wrapper

- Wall Street Journal - Markets. (2022). Microsoft Corp. Wsj.com. https://www.wsj.com/market-data/quotes/MSFT/financials/annual/balance-sheet

Wall Street Journal. (2022). Apple Inc. Wsj.com. https://www.wsj.com/market-data/quotes/AAPL/financials/annual/income-statement

- Industry data from:

- Market Line. (2022, June 30). United States - I.T. Hardware. Snhu.edu. https://advantage-marketline-com.ezproxy.snhu.edu/Analysis/ViewasPDF/united-states-it-hardware-155602

United States Environmental Protection Agency. (2013, February 25). Computer and Electronic Product Manufacturing Sector (NAICS 334) | US EPA. US EPA. https://www.epa.gov/regulatory-information-sector/computer-and-electronic-product-manufacturing-sector-naics-334

- Economic data from:

Cohan, P. (2022, September 29). Fed Governors Shed No New Light On 4.6% Peak Funds Rate. Forbes. https://www.forbes.com/sites/petercohan/2022/09/27/fed-governors-shed-no-new-light-on-46-peak-funds-rate/?sh=5ae52f1230e3

Federal Reserve Bank of San Francisco. (2012, November 7). What is the Fed: Monetary Policy. San Francisco Fed; Federal Reserve Bank of San Francisco. https://www.frbsf.org/education/teacher-resources/what-is-the-fed/monetary-policy/

Kulkarni, P. (2014, June 9). Five macro-economic indicators that may affect your investments. The Economic Times; Economic Times. https://m.economictimes.com/news/economy/indicators/five-macro-economic-indicators-that-may-affect-your-investments/articleshow/36198431.cms

Logue, A. (2022, May 29). Trade Policy. The Balance. https://www.thebalancemoney.com/what-is-trade-policy-5217002

- MSFT - Microsoft Corp Shareholders - CNNMoney.com. (2022). Cnn.com. https://money.cnn.com/quote/shareholders/shareholders.html?symb=MSFT&subView=institutional

U.S. Bureau of Economic Analysis (BEA). (2022). Gross Domestic Product | U.S. Bureau of Economic Analysis (BEA). Bea.gov. https://www.bea.gov/data/gdp/gross-domestic-product

- Other sources:

- BizWorth. (2020). An Introduction - Three Approaches to Valuing Your Business [YouTube Video]. In YouTube. https://www.youtube.com/watch?v=d6IXwJMIoVU&list=PLIkwn-wPP380InLnRKzb3meGH2KTIuxXN

Corporate Finance Institute. (2020, July 17). Discount for Lack of Marketability (DLOM). Corporate Finance Institute; Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/knowledge/valuation/discount-for-lack-of-marketability-dlom/

- Fidelity International. (2015). Fidelity.com.sg. https://www.fidelity.com.sg/beginners/your-guide-to-stock-investing/the-power-of-dividends-how-they-can-drive-returns

- Gordon, J. (2022, May 17). Lack of Control Discount (Stock) - Explained. The Business Professor, LLC. https://thebusinessprofessor.com/en_US/investments-trading-financial-markets/lack-of-control-discount-stock-explained

Hayes, A. (2022, July 11). Profitability Ratios: What They Are, Common Types, and How Businesses Use Them. Investopedia. https://www.investopedia.com/terms/p/profitabilityratios.asp

Kochhar, R., & Bennett, J. (2021, April 14). U.S. labor market inches back from the COVID-19 shock, but recovery is far from complete. Pew Research Center; Pew Research Center. https://www.pewresearch.org/fact-tank/2021/04/14/u-s-labor-market-inches-back-from-the-covid-19-shock-but-recovery-is-far-from-complete/

Lisa, A. (2021, August 25). 4 Critical Industries Affected by the Chip Shortage. Yahoo.com; Yahoo. https://www.yahoo.com/video/4-critical-industries-affected-chip-013610213.html

Microsoft. (2021). Microsoft 2021 Annual Report. Microsoft.com. https://www.microsoft.com/investor/reports/ar21/index.html

- Microsoft. (2022, July 29). Facts About Microsoft - Stories. Stories. https://news.microsoft.com/facts-about-microsoft/

Murphy, C. (2022, May 18). What Is the Formula for Calculating Free Cash Flow? Investopedia. https://www.investopedia.com/ask/answers/033015/what-formula-calculating-free-cash-flow.aspx

Novet, J. (2022, July 12). Microsoft cuts small percentage of employees as new fiscal year begins. CNBC; CNBC. https://www.cnbc.com/2022/07/12/microsoft-cuts-small-percentage-of-employees-as-new-fiscal-year-begins.html

Osano Staff. (2022, July 4). Data privacy laws: What you need to know in 2022. Osano; Osano, Inc. https://www.osano.com/articles/data-privacy-laws

Reichenbach, Z. (2020, March 25). The Discount Rate and Business Valuations | Vallit Advisors. Vallit Advisors. https://www.vallitadvisors.com/news/2020/05/the-discount-rate-and-business-valuations/#:~:text=As%20it%20relates%20to%20business,form%20of%20equity%20and%20debt.

Sudhanshu D. (2019, December 16). Who are biggest customers of the Microsoft Azure Platform? Cisin.com; Cisin. https://www.cisin.com/coffee-break/enterprise/who-are-biggest-customers-of-the-microsoft-azure-platform.html

Y Charts. (2022). US 10-Year Government Bond Interest Rate. Ycharts.com; YCharts. https://ycharts.com/indicators/us_10year_government_bond_interest_rate